Understanding Car Loan Interest Rates in Oregon: What You Need to Know

#### Car Loan Interest Rates OregonWhen it comes to financing a vehicle in Oregon, understanding the car loan interest rates Oregon is crucial for making in……

#### Car Loan Interest Rates Oregon

When it comes to financing a vehicle in Oregon, understanding the car loan interest rates Oregon is crucial for making informed decisions. Car loan interest rates can vary significantly based on various factors, including your credit score, the type of vehicle you are purchasing, and the lender you choose. In this comprehensive guide, we will explore everything you need to know about car loan interest rates in Oregon, helping you navigate the process with confidence.

#### Factors Affecting Car Loan Interest Rates in Oregon

Several key factors influence the car loan interest rates Oregon residents encounter. First and foremost is your credit score. Lenders typically categorize borrowers into different tiers based on their creditworthiness. A higher credit score often results in lower interest rates, while a lower score can lead to higher rates or even loan denial.

Another important factor is the loan term. Shorter loan terms generally come with lower interest rates, but they also mean higher monthly payments. Conversely, longer loan terms may offer lower monthly payments but can result in higher overall interest costs. It’s essential to strike a balance that fits your financial situation.

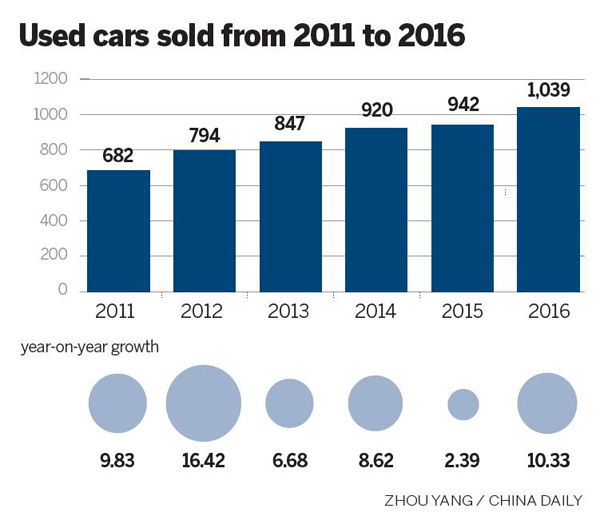

The type of vehicle you are purchasing can also affect your interest rate. New cars often come with lower rates compared to used cars, as they are considered less risky for lenders. Additionally, the loan-to-value ratio (LTV) plays a role; a lower LTV, which means you’re financing a smaller portion of the vehicle’s value, can lead to better rates.

#### Current Trends in Car Loan Interest Rates in Oregon

As of 2023, the car loan interest rates Oregon residents are experiencing have shown some fluctuations due to economic conditions and changes in the automotive market. It’s important to stay updated on current trends, as rates can shift based on factors such as inflation, Federal Reserve policies, and the overall demand for vehicles.

To find the most competitive rates, it’s advisable to shop around and compare offers from various lenders, including banks, credit unions, and online lenders. Each lender may have different criteria and rates, so doing your research can save you a significant amount of money over the life of the loan.

#### How to Secure the Best Car Loan Interest Rates in Oregon

Securing the best car loan interest rates Oregon has to offer requires a proactive approach. Start by checking your credit report for errors and working to improve your credit score if necessary. Paying down existing debts and making timely payments can help boost your score over time.

Additionally, consider getting pre-approved for a loan before visiting dealerships. Pre-approval not only gives you a clearer picture of what you can afford but also strengthens your negotiating position when discussing financing options with dealerships.

Finally, don’t hesitate to negotiate the terms of your loan. Many lenders are willing to work with you to find a rate that fits your budget, especially if you have a solid credit history.

#### Conclusion

In summary, understanding car loan interest rates Oregon is essential for anyone looking to finance a vehicle in the state. By considering the factors that influence rates, staying informed about current trends, and taking proactive steps to secure the best deal, you can navigate the car loan process with confidence. Whether you’re purchasing a new or used vehicle, being informed will empower you to make the best financial decision for your situation.