Can I Deduct Home Equity Loan Interest? Unlocking the Secrets to Maximizing Your Tax Benefits

#### Description:When considering financial strategies for homeownership, many homeowners often ask, "Can I deduct home equity loan interest?" This question……

#### Description:

When considering financial strategies for homeownership, many homeowners often ask, "Can I deduct home equity loan interest?" This question is crucial for anyone looking to maximize their tax benefits while managing their home equity loans effectively. Understanding the ins and outs of home equity loan interest deductions can lead to significant savings, making it a topic worth exploring in detail.

#### What is a Home Equity Loan?

A home equity loan allows homeowners to borrow against the equity they have built in their property. This type of loan can be a valuable financial tool, often used for home improvements, debt consolidation, or other large expenses. The interest paid on these loans may be tax-deductible, which is where the question of "Can I deduct home equity loan interest?" becomes particularly relevant.

#### The Tax Deduction Landscape

As of the Tax Cuts and Jobs Act (TCJA) enacted in 2017, the rules surrounding the deduction of home equity loan interest have changed. Homeowners can still deduct interest on home equity loans, but there are specific conditions. To qualify, the loan must be secured by your primary or secondary residence, and the funds must be used for "buying, building, or substantially improving" your home.

#### Key Considerations for Deducting Home Equity Loan Interest

1. **Loan Purpose**: To take advantage of the deduction, ensure that the money borrowed is used for qualifying purposes. If you use the funds for personal expenses, such as paying off credit card debt or funding a vacation, you may lose the ability to deduct the interest.

2. **Loan Limits**: The total amount of debt that qualifies for the interest deduction is capped. As of the current tax regulations, the combined total of your mortgage debt and home equity loans cannot exceed $750,000 (or $375,000 if married filing separately) for loans taken out after December 15, 2017.

3. **Itemizing Deductions**: To benefit from the deduction, you must itemize your deductions on your tax return. This means you will need to forego the standard deduction. For some taxpayers, especially those with lower mortgage interest or fewer deductible expenses, itemizing may not be beneficial.

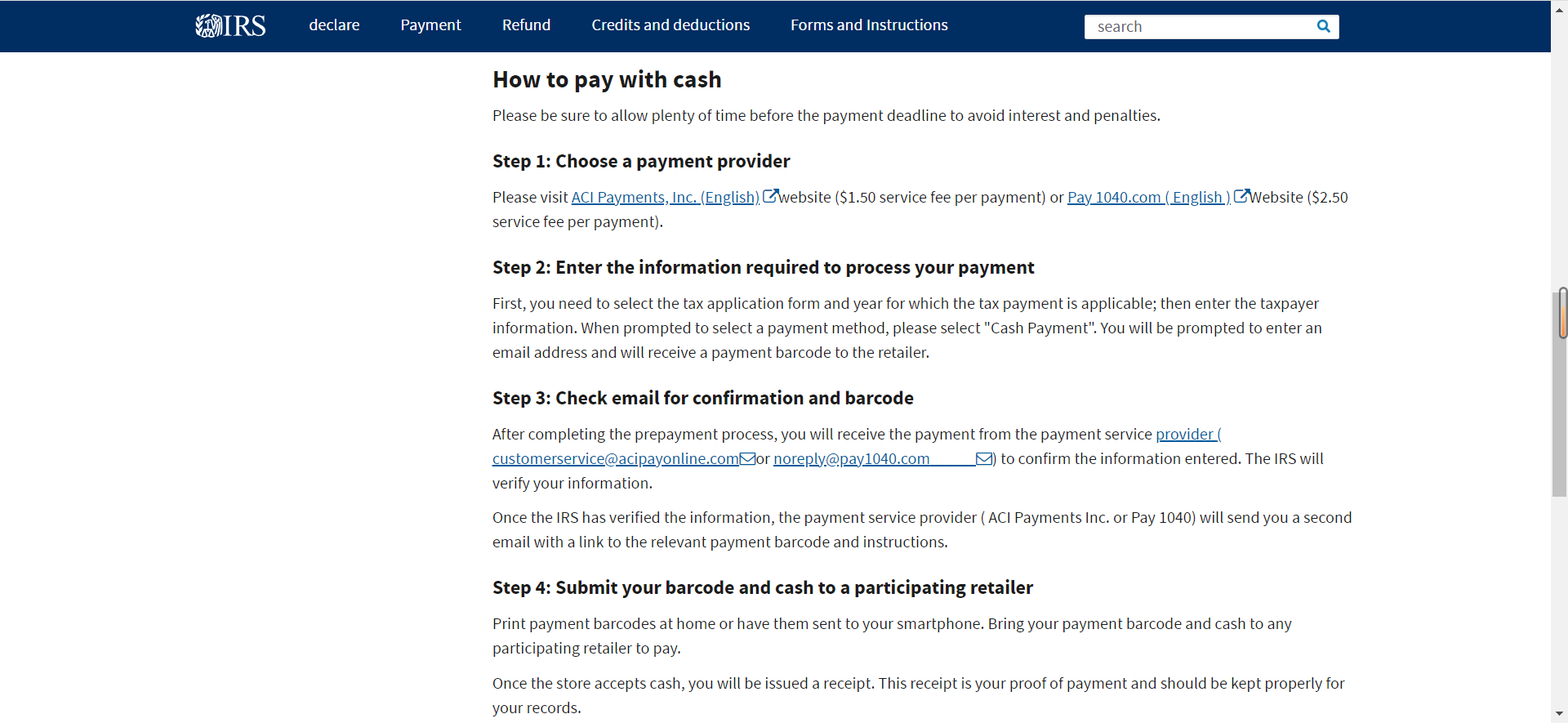

4. **Tax Filing**: When filing your taxes, ensure you have the necessary documentation, such as Form 1098, which your lender will provide, detailing the interest paid on your home equity loan. This form will help you accurately report your deductions.

5. **Consulting a Tax Professional**: Tax laws can be complex and subject to change. Consulting with a tax professional can provide personalized advice tailored to your financial situation, ensuring you maximize your deductions while remaining compliant with IRS regulations.

#### Conclusion: Making the Most of Your Home Equity

In summary, the question "Can I deduct home equity loan interest?" has a nuanced answer that depends on several factors, including the purpose of the loan, the total amount of debt, and your tax filing method. By understanding these elements and staying informed about current tax laws, homeowners can make informed decisions that optimize their financial outcomes. Whether you're looking to renovate your home, consolidate debt, or finance a major purchase, leveraging home equity wisely can lead to substantial benefits, both in terms of cash flow and tax savings. Always remember to keep abreast of changes in tax legislation and consult with a professional to navigate your unique financial landscape effectively.