Unlock Your Dream Home: Discover Competitive Construction Loan Rates in Ohio

Guide or Summary:What Are Construction Loans?Factors Influencing Construction Loan Rates in OhioCurrent Construction Loan Rates in OhioHow to Secure the Bes……

Guide or Summary:

- What Are Construction Loans?

- Factors Influencing Construction Loan Rates in Ohio

- Current Construction Loan Rates in Ohio

- How to Secure the Best Construction Loan Rates in Ohio

When it comes to building your dream home in Ohio, understanding the financial landscape is crucial. One of the most significant factors that can influence your home-building journey is the construction loan rates Ohio. These rates can vary widely based on numerous factors, including your credit score, the lender, and the current economic climate. In this article, we will explore the various aspects of construction loan rates in Ohio, helping you make informed decisions that can save you money and stress.

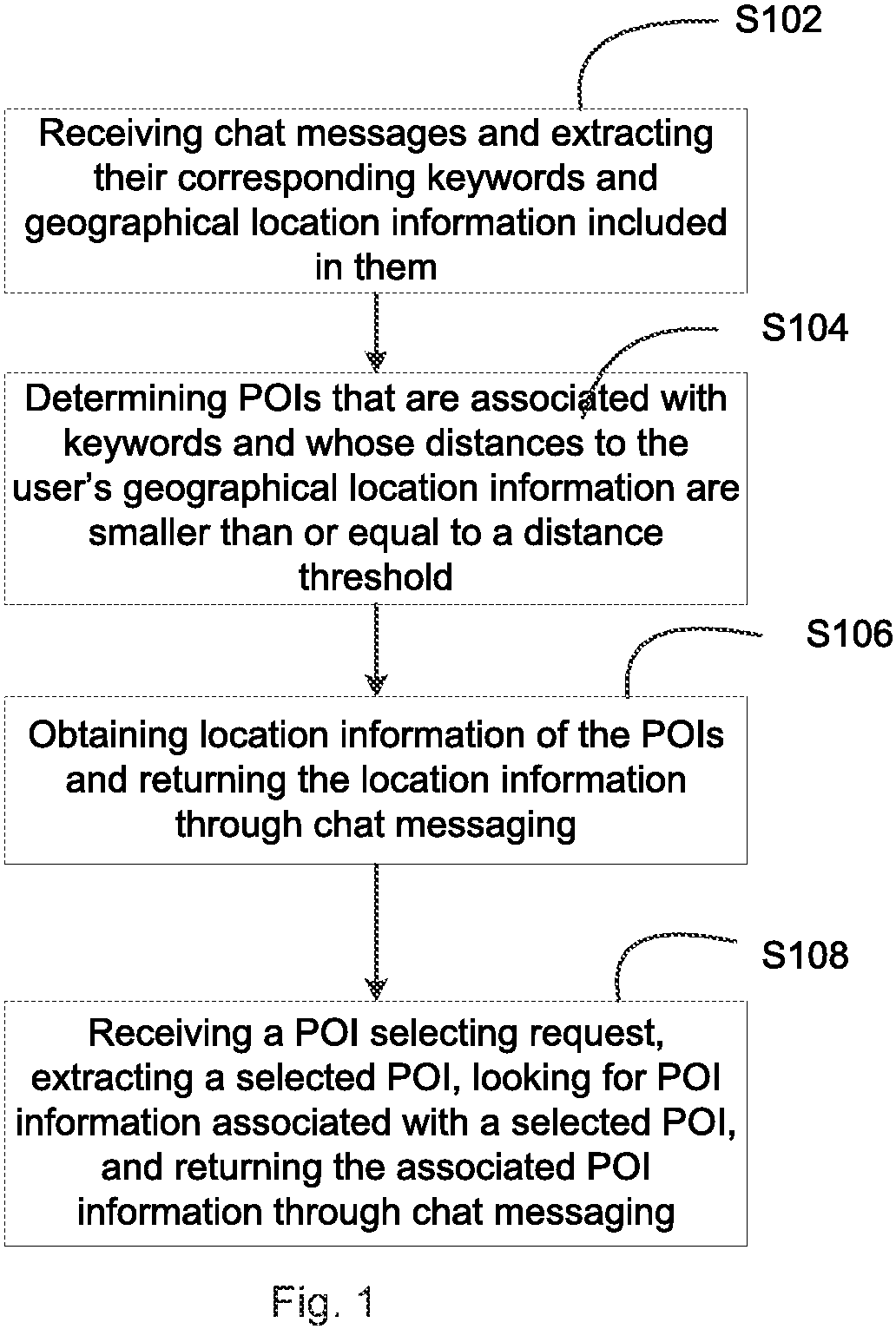

What Are Construction Loans?

Before diving into the specifics of construction loan rates Ohio, it’s essential to understand what construction loans are. Unlike traditional mortgages, construction loans are short-term financing options that cover the costs of building a home. These loans typically have higher interest rates compared to conventional mortgages due to the increased risk involved in lending for a property that is not yet completed.

Factors Influencing Construction Loan Rates in Ohio

Several factors can influence the construction loan rates you may encounter in Ohio. Here are the key elements to consider:

1. **Credit Score**: Your credit score plays a significant role in determining the interest rate you will receive. A higher credit score can lead to lower rates, while a lower score may result in higher rates or even disqualification.

2. **Loan Amount**: The amount you wish to borrow can also affect your rates. Larger loans might come with different terms and conditions compared to smaller ones.

3. **Lender Type**: Different lenders have varying rates and terms. It’s essential to shop around and compare offers from banks, credit unions, and online lenders to find the best deal.

4. **Market Conditions**: Economic factors such as inflation, the Federal Reserve’s interest rate decisions, and overall market demand can influence construction loan rates.

5. **Loan Type**: There are different types of construction loans, including fixed-rate loans, variable-rate loans, and interest-only loans. Each type comes with its own set of rates and terms.

Current Construction Loan Rates in Ohio

As of now, the construction loan rates Ohio can range from 3% to 7%, depending on the factors mentioned above. It’s essential to keep in mind that these rates can fluctuate, so staying informed and checking regularly can help you secure the best possible deal.

How to Secure the Best Construction Loan Rates in Ohio

To ensure you get the most competitive construction loan rates Ohio, consider the following tips:

1. **Improve Your Credit Score**: Before applying for a loan, take steps to improve your credit score. Pay down debts, make timely payments, and avoid taking on new debt.

2. **Shop Around**: Don’t settle for the first offer you receive. Compare rates from multiple lenders to find the most favorable terms.

3. **Consider a Larger Down Payment**: A larger down payment can reduce the lender’s risk, potentially leading to better rates.

4. **Understand the Terms**: Ensure you fully understand the loan terms, including any fees, penalties, and the repayment schedule.

5. **Consult a Financial Advisor**: If you’re unsure about the process, consulting a financial advisor can provide valuable insights and help you navigate the complexities of construction loans.

Navigating the world of construction loan rates Ohio doesn’t have to be a daunting task. By understanding the various factors that influence these rates and taking proactive steps to secure the best deal, you can turn your dream of building a home into a reality. Remember to do your research, compare options, and consult professionals when needed. With the right approach, you can find a construction loan that fits your financial situation and helps you build the home of your dreams.