Discover the Best Online Loans Companies for Your Financial Needs

#### Description:In today's fast-paced world, the need for quick and accessible financial solutions has never been more critical. Whether you're facing unex……

#### Description:

In today's fast-paced world, the need for quick and accessible financial solutions has never been more critical. Whether you're facing unexpected expenses, planning a major purchase, or consolidating debt, online loans companies have emerged as a convenient option to meet your monetary needs. This article explores the landscape of online loans companies, highlighting their benefits, types of loans available, and how to choose the right company for your situation.

#### The Rise of Online Loans Companies

The digital revolution has transformed how we manage our finances, leading to the rise of online loans companies. Unlike traditional banks, these companies operate primarily through the internet, allowing borrowers to apply for loans from the comfort of their homes. This shift has made the lending process faster, more efficient, and often more accessible for a broader range of consumers.

#### Benefits of Using Online Loans Companies

1. **Speed and Convenience**: One of the most significant advantages of online loans companies is the speed of the application process. Many companies offer instant pre-approval, allowing you to know your eligibility within minutes. Once approved, funds can often be deposited into your account within 24 hours.

2. **Accessibility**: With online loans, you can apply anytime and anywhere, making it easier for individuals with busy schedules or those living in remote areas to access financial assistance. This accessibility extends to those with less-than-perfect credit scores, as many online loans companies specialize in serving borrowers who may be overlooked by traditional lenders.

3. **Variety of Loan Options**: Online loans companies offer a wide range of loan types, including personal loans, payday loans, and installment loans. This variety allows borrowers to find a product that best suits their financial situation and repayment capabilities.

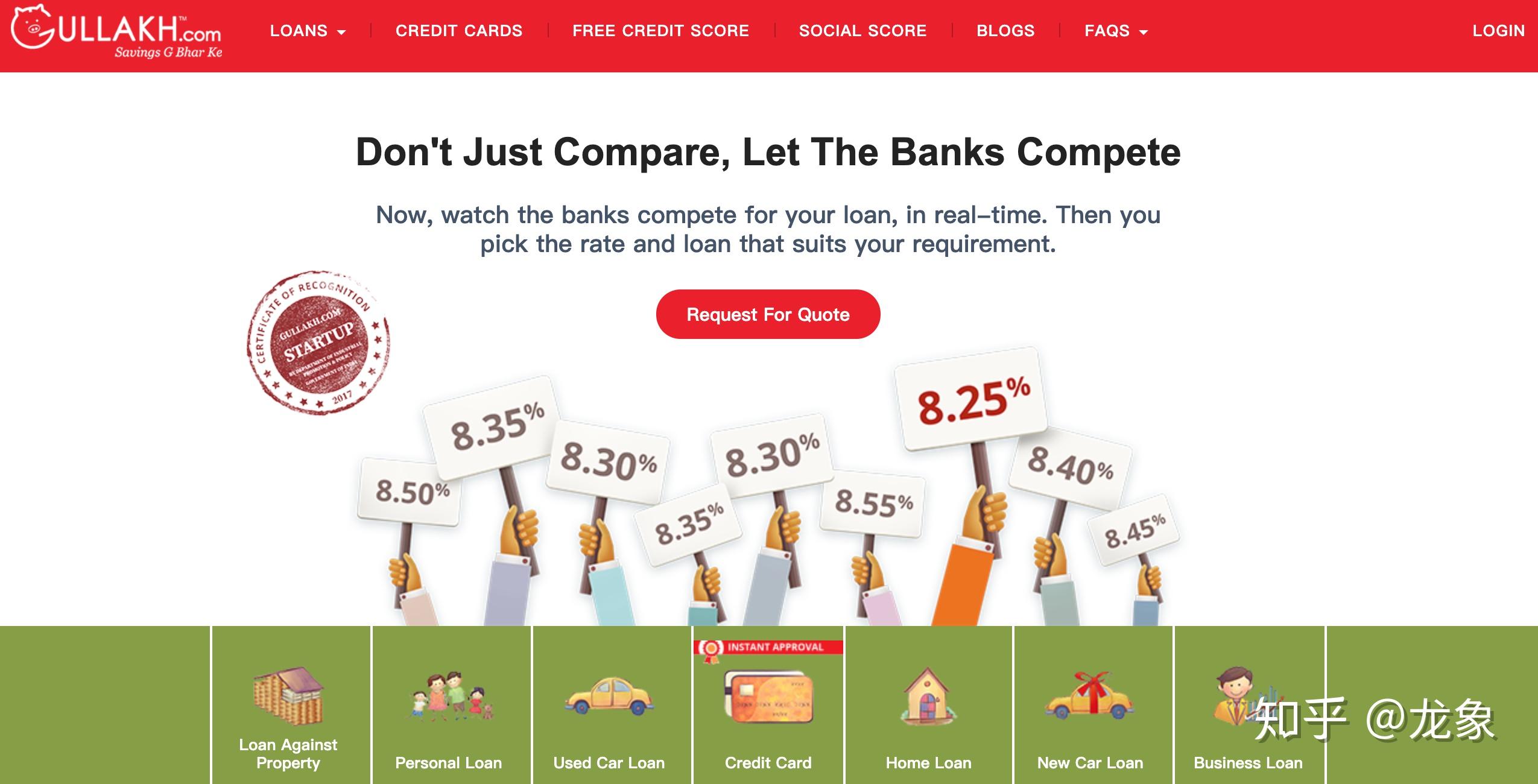

4. **Competitive Rates**: Due to lower overhead costs, many online loans companies can offer competitive interest rates compared to traditional banks. This can result in significant savings over the life of the loan.

#### Types of Loans Offered by Online Loans Companies

1. **Personal Loans**: These are unsecured loans that can be used for various purposes, from medical bills to home renovations. Personal loans typically have fixed interest rates and repayment terms, making them a popular choice for many borrowers.

2. **Payday Loans**: Designed for short-term financial needs, payday loans provide quick cash to cover immediate expenses. However, they often come with high-interest rates and should be used cautiously.

3. **Installment Loans**: These loans are repaid in fixed installments over a set period. They can be used for larger purchases and can offer more manageable repayment schedules.

4. **Debt Consolidation Loans**: If you’re struggling with multiple debts, a debt consolidation loan from an online loans company can help you combine them into a single payment, often at a lower interest rate.

#### Choosing the Right Online Loans Company

When selecting an online loans company, it's crucial to consider several factors:

1. **Reputation and Reviews**: Research the company’s reputation by reading customer reviews and checking ratings on platforms like the Better Business Bureau (BBB). A company with positive feedback is more likely to provide a satisfactory borrowing experience.

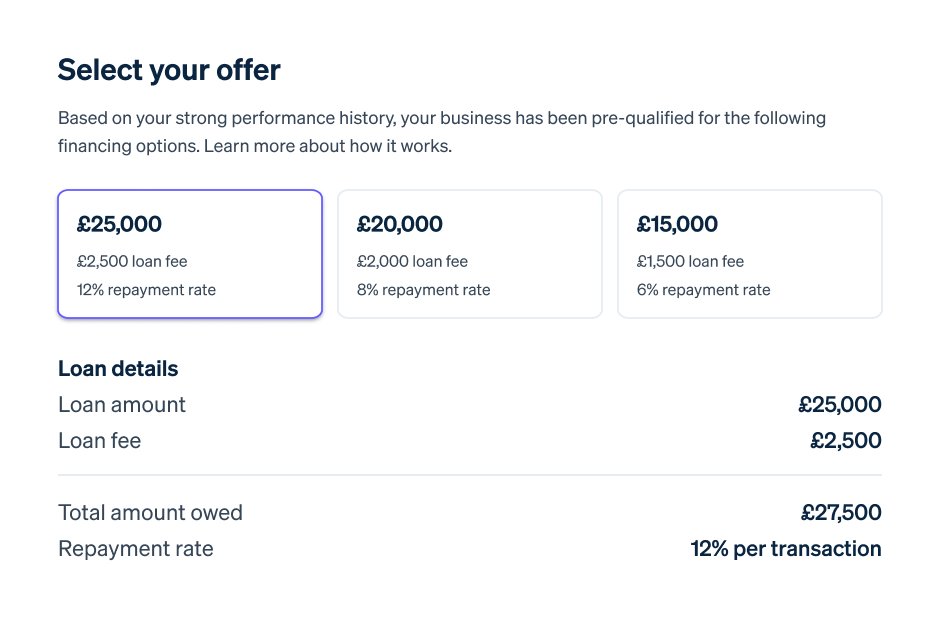

2. **Transparency**: Look for companies that clearly outline their fees, interest rates, and terms. Avoid lenders that use hidden fees or complicated language that may lead to misunderstandings.

3. **Customer Service**: A trustworthy online loans company should offer robust customer support, including multiple channels for communication. This is particularly important if you have questions or concerns during the application process.

4. **Loan Terms**: Compare loan terms from different companies, including interest rates, repayment periods, and any additional fees. This will help you find a loan that aligns with your financial goals.

#### Conclusion

In conclusion, online loans companies offer a convenient and accessible way to meet your financial needs. With their speed, variety of loan options, and competitive rates, they can be an excellent resource for anyone looking to borrow money. However, it’s essential to conduct thorough research and choose a reputable lender to ensure a smooth borrowing experience. By understanding the benefits and options available, you can make informed decisions that will help you achieve your financial goals.