How to Access Your SBA EIDL Loan Login: A Comprehensive Guide

#### SBA EIDL Loan LoginThe Small Business Administration (SBA) Economic Injury Disaster Loan (EIDL) program is a vital resource for businesses affected by……

#### SBA EIDL Loan Login

The Small Business Administration (SBA) Economic Injury Disaster Loan (EIDL) program is a vital resource for businesses affected by disasters, including the COVID-19 pandemic. Understanding how to navigate the SBA EIDL loan login process is essential for business owners seeking financial assistance. This guide will walk you through the steps to access your account, manage your loan, and utilize the resources available to you.

#### Understanding the SBA EIDL Program

The SBA EIDL program provides low-interest loans to small businesses and non-profits that have suffered substantial economic injury due to a disaster. The funds can be used for various purposes, including working capital, payroll, and other operational expenses. It's crucial to familiarize yourself with the benefits and requirements of the EIDL program to make the most of this financial support.

#### Steps to Access Your SBA EIDL Loan Login

1. **Visit the Official SBA Website**: To begin, navigate to the official SBA website. This is where you will find the portal for the EIDL loan application and login.

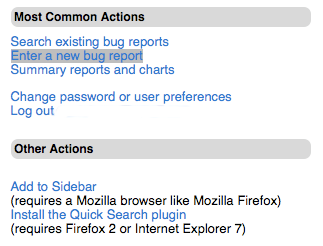

2. **Locate the EIDL Portal**: On the SBA homepage, look for the EIDL loan section. This may be found under the “Loans” or “Disaster Assistance” tabs.

3. **Enter Your Credentials**: Click on the login option. You will need to enter your username and password. If you have forgotten your credentials, there are options available to reset your password or recover your username.

4. **Dashboard Overview**: Once logged in, you will be directed to your dashboard. Here, you can view your loan status, payment history, and any outstanding documents that need your attention.

5. **Manage Your Loan**: The portal allows you to manage your loan effectively. You can make payments, request assistance, or even apply for additional funding if necessary.

#### Common Issues and Troubleshooting

Many users encounter issues when trying to log in to their SBA EIDL accounts. If you face difficulties, consider the following troubleshooting tips:

- **Check Internet Connection**: Ensure you have a stable internet connection. A weak connection can cause login issues.

- **Browser Compatibility**: Sometimes, using a different web browser can resolve access issues. Make sure your browser is updated to the latest version.

- **Clear Cache and Cookies**: Clearing your browser's cache and cookies can help resolve any loading issues related to the SBA website.

- **Contact Support**: If you continue to experience problems, do not hesitate to reach out to the SBA’s customer support for assistance.

#### Utilizing Resources Available Through the SBA EIDL Portal

Once you have successfully logged in, take advantage of the resources available to you. The SBA provides various tools and information that can help you manage your loan effectively:

- **Loan Information**: Access detailed information about your loan, including interest rates, repayment terms, and remaining balances.

- **Payment Options**: Explore different payment options that suit your financial situation. The portal may provide various methods for making payments, such as online payments or bank transfers.

- **Guidance and FAQs**: The SBA website has a wealth of information, including FAQs that can help answer common questions about the EIDL program.

- **Updates and Announcements**: Stay informed about any changes to the EIDL program or new resources that may become available by regularly checking the portal.

#### Conclusion

Accessing your SBA EIDL loan login is a straightforward process that can significantly benefit your business. By understanding how to navigate the SBA portal, you can manage your loan effectively and ensure that you are making the most of the resources available to you. Remember to keep your login credentials secure and reach out for assistance whenever necessary. With the right tools and information, you can navigate the challenges of running a small business during difficult times.