Understanding FHA Jumbo Loan Limits: What You Need to Know for 2023

#### FHA Jumbo Loan LimitsFHA jumbo loan limits refer to the maximum loan amounts that the Federal Housing Administration (FHA) will insure for loans that e……

#### FHA Jumbo Loan Limits

FHA jumbo loan limits refer to the maximum loan amounts that the Federal Housing Administration (FHA) will insure for loans that exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These limits vary by county and are influenced by the cost of housing in different areas. In 2023, understanding these limits is crucial for homebuyers looking to finance properties that are above the conventional loan thresholds.

#### What Are FHA Jumbo Loans?

FHA jumbo loans are designed for borrowers who need to finance higher-priced homes that exceed the traditional conforming loan limits. While conventional loans are typically capped at a certain amount (which varies by region), FHA loans provide an option for those who require larger sums. The FHA insures these loans, which allows lenders to offer more favorable terms to borrowers, including lower down payments and more lenient credit score requirements.

#### Why FHA Jumbo Loan Limits Matter

Understanding FHA jumbo loan limits is essential for potential homebuyers. These limits dictate how much you can borrow under the FHA program. If you find a home that exceeds these limits, you may need to consider alternative financing options, such as a conventional jumbo loan, which often comes with stricter credit requirements and higher down payments. Knowing the specific limits in your area can help you make informed decisions about your home purchase.

#### How Are FHA Jumbo Loan Limits Determined?

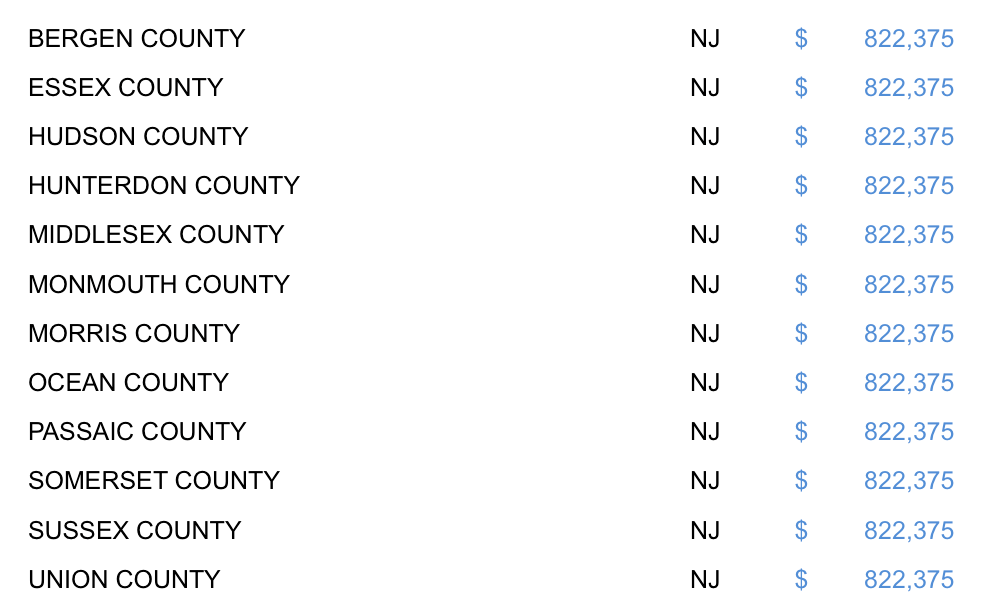

FHA jumbo loan limits are determined based on the median home prices in different regions. The Department of Housing and Urban Development (HUD) reviews housing data regularly to adjust these limits accordingly. For example, areas with higher housing costs, such as major metropolitan cities, will typically have higher FHA jumbo loan limits compared to rural areas. It’s important to check the current limits for your specific county to understand your borrowing capacity.

#### Current FHA Jumbo Loan Limits for 2023

As of 2023, the FHA has set specific jumbo loan limits that vary by county. For most areas, the limit is set at $1,000,000, but in high-cost areas, this can be significantly higher. Homebuyers should consult the HUD website or their local FHA-approved lender to obtain the most accurate and up-to-date information regarding these limits.

#### Benefits of FHA Jumbo Loans

One of the primary benefits of FHA jumbo loans is the lower down payment requirement. Borrowers can often secure financing with as little as 3.5% down, making it more accessible for first-time homebuyers. Additionally, FHA loans are known for their flexible credit score requirements, which can be beneficial for individuals with less-than-perfect credit histories. This makes FHA jumbo loans an attractive option for many buyers looking to purchase higher-priced homes.

#### Conclusion

In conclusion, understanding FHA jumbo loan limits is vital for anyone looking to purchase a home that exceeds conventional loan thresholds. By familiarizing yourself with the limits in your area and the benefits of FHA jumbo loans, you can navigate the homebuying process more effectively. Always consult with a knowledgeable lender to explore your options and ensure you are making the best financial decision for your situation. Whether you're a first-time buyer or looking to upgrade, knowing the ins and outs of FHA jumbo loan limits can make a significant difference in your home financing journey.