Understanding Sallie Mae Student Loan Forgiveness: Your Comprehensive Guide to Relief Options

Guide or Summary:Sallie Mae Student Loan Forgiveness is a crucial topic for many borrowers seeking relief from their education debt. With the rising cost of……

Guide or Summary:

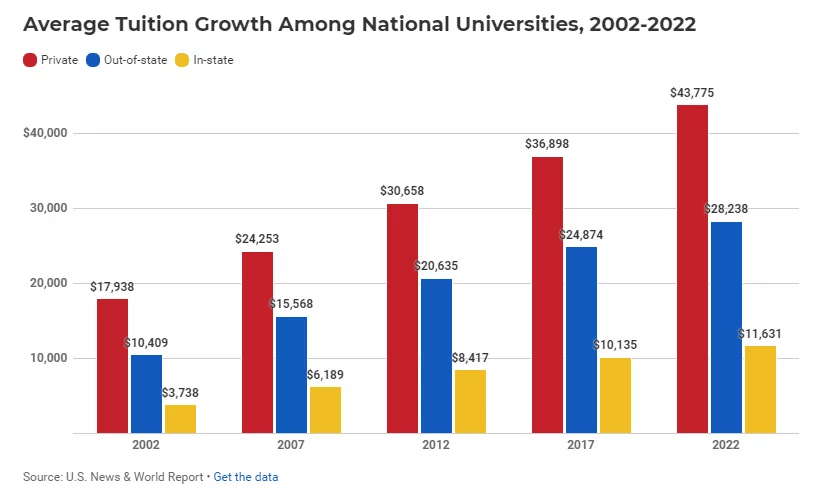

- Sallie Mae Student Loan Forgiveness is a crucial topic for many borrowers seeking relief from their education debt. With the rising cost of education, student loans have become a significant burden for millions of graduates. Sallie Mae, one of the largest student loan servicers in the United States, offers various options for borrowers to manage their loans, including potential forgiveness programs.

- What is Sallie Mae Student Loan Forgiveness?

- Eligibility for Sallie Mae Student Loan Forgiveness

- Types of Forgiveness Programs

- How to Apply for Sallie Mae Student Loan Forgiveness

- Challenges and Considerations

#### Description

Sallie Mae Student Loan Forgiveness is a crucial topic for many borrowers seeking relief from their education debt. With the rising cost of education, student loans have become a significant burden for millions of graduates. Sallie Mae, one of the largest student loan servicers in the United States, offers various options for borrowers to manage their loans, including potential forgiveness programs.

What is Sallie Mae Student Loan Forgiveness?

Sallie Mae Student Loan Forgiveness refers to the various programs and options available to borrowers that allow them to reduce or eliminate their student loan debt under specific circumstances. This forgiveness can be a lifeline for those struggling to make monthly payments or facing financial hardship.

Eligibility for Sallie Mae Student Loan Forgiveness

Not all borrowers qualify for forgiveness. Eligibility typically depends on several factors, including the type of loan, the borrower's employment status, and the repayment plan they are enrolled in. For example, federal student loans may offer more forgiveness options compared to private loans. Borrowers should review their loan agreements and consult with a financial advisor or loan servicer to understand their specific situation.

Types of Forgiveness Programs

There are several types of forgiveness programs that may apply to Sallie Mae loans. These include:

1. **Public Service Loan Forgiveness (PSLF)**: Available for borrowers who work in qualifying public service jobs. After making 120 qualifying payments, borrowers may have the remaining balance forgiven.

2. **Teacher Loan Forgiveness**: Teachers who work in low-income schools may qualify for forgiveness after five years of service.

3. **Income-Driven Repayment (IDR) Forgiveness**: Borrowers enrolled in IDR plans may have their remaining loan balance forgiven after 20 or 25 years of qualifying payments.

How to Apply for Sallie Mae Student Loan Forgiveness

Applying for forgiveness can be a complex process. Borrowers should start by gathering all necessary documentation, including proof of employment, income, and payment history. It is essential to fill out the correct forms and submit them to the appropriate servicer. Additionally, staying informed about any changes in federal or state policies regarding student loans is crucial, as these can impact forgiveness options.

Challenges and Considerations

While forgiveness sounds appealing, there are challenges to consider. The application process can be lengthy and requires meticulous documentation. Additionally, not all loans are eligible for forgiveness, particularly private loans from Sallie Mae. Borrowers should also be aware of potential tax implications on forgiven amounts, as some states may consider forgiven debt as taxable income.

In conclusion, Sallie Mae Student Loan Forgiveness offers various pathways for borrowers to alleviate their student loan burden. Understanding the eligibility criteria, types of forgiveness programs, and the application process is essential for those seeking relief. By staying informed and proactive, borrowers can navigate the complexities of student loans and work towards a debt-free future. For personalized advice, consider reaching out to a financial advisor or a student loan expert who can provide tailored guidance based on your unique situation.