"Maximizing Your Home Equity Loan with High DTI: Strategies for Homeowners"

#### Understanding Home Equity LoansA home equity loan is a type of loan that allows homeowners to borrow against the equity they have built up in their pro……

#### Understanding Home Equity Loans

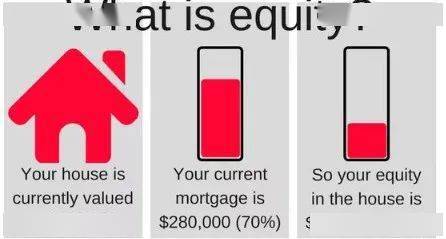

A home equity loan is a type of loan that allows homeowners to borrow against the equity they have built up in their property. Equity is the difference between the market value of the home and the outstanding mortgage balance. Home equity loans are often used for significant expenses such as home renovations, debt consolidation, or major life events.

#### What is a High DTI?

DTI, or Debt-to-Income ratio, is a financial measure that compares an individual's total monthly debt payments to their gross monthly income. A high DTI indicates that a large portion of your income is going towards paying off debts, which can be a red flag for lenders. Typically, a DTI above 43% is considered high, making it challenging to secure new loans, including home equity loans.

#### The Challenge of High DTI with Home Equity Loans

When applying for a home equity loan with a high DTI, homeowners face unique challenges. Lenders may view a high DTI as a sign of financial risk, potentially leading to higher interest rates or even denial of the loan application. This can be particularly frustrating for homeowners who have significant equity in their homes but struggle with existing debt obligations.

#### Strategies to Secure a Home Equity Loan with High DTI

1. **Improve Your Credit Score**: Before applying for a home equity loan, it’s crucial to check your credit score. A higher credit score can help mitigate the impact of a high DTI, as it demonstrates to lenders that you are a responsible borrower. Consider paying down existing debts, making payments on time, and correcting any errors on your credit report.

2. **Increase Your Income**: If possible, look for ways to increase your monthly income. This could involve taking on a part-time job, freelancing, or selling unused items. A higher income can help lower your DTI and make you a more attractive candidate for a home equity loan.

3. **Consider a Co-Signer**: If you have a family member or friend with a strong financial profile, consider asking them to co-sign the loan. A co-signer can provide additional assurance to lenders, potentially offsetting the risks associated with your high DTI.

4. **Shop Around for Lenders**: Not all lenders have the same criteria for approving home equity loans. Some may be more flexible with high DTI ratios than others. Take the time to research and compare different lenders to find one that suits your financial situation.

5. **Explore Alternative Financing Options**: If securing a home equity loan proves too difficult, consider alternative financing options. These could include personal loans, cash-out refinancing, or government programs designed to assist homeowners in financial distress.

#### Conclusion

Navigating the landscape of home equity loans with a high DTI can be daunting, but it is not impossible. By understanding your financial situation, improving your credit score, exploring alternative income sources, and shopping around for the right lender, you can increase your chances of securing the funding you need. Remember, the key is to present yourself as a responsible borrower, even in the face of a high DTI. With careful planning and strategic decision-making, you can leverage your home equity to achieve your financial goals.