Understanding Student Loan Totals: A Comprehensive Guide to Managing Your Debt

#### Student Loan TotalsIn recent years, the topic of student loan totals has gained significant attention as more individuals pursue higher education. As c……

#### Student Loan Totals

In recent years, the topic of student loan totals has gained significant attention as more individuals pursue higher education. As college tuition continues to rise, understanding the implications of these totals becomes increasingly important for students and their families. This guide aims to provide insights into what student loan totals mean, how they are calculated, and strategies for managing this financial burden.

#### What Are Student Loan Totals?

refer to the cumulative amount of money borrowed by students to finance their education. This figure typically includes federal and private loans, which can vary widely based on the type of institution attended, the program of study, and the student's financial situation. For many graduates, these totals can reach into the tens or even hundreds of thousands of dollars, making it crucial to understand the long-term implications of such debt.

#### Factors Influencing Student Loan Totals

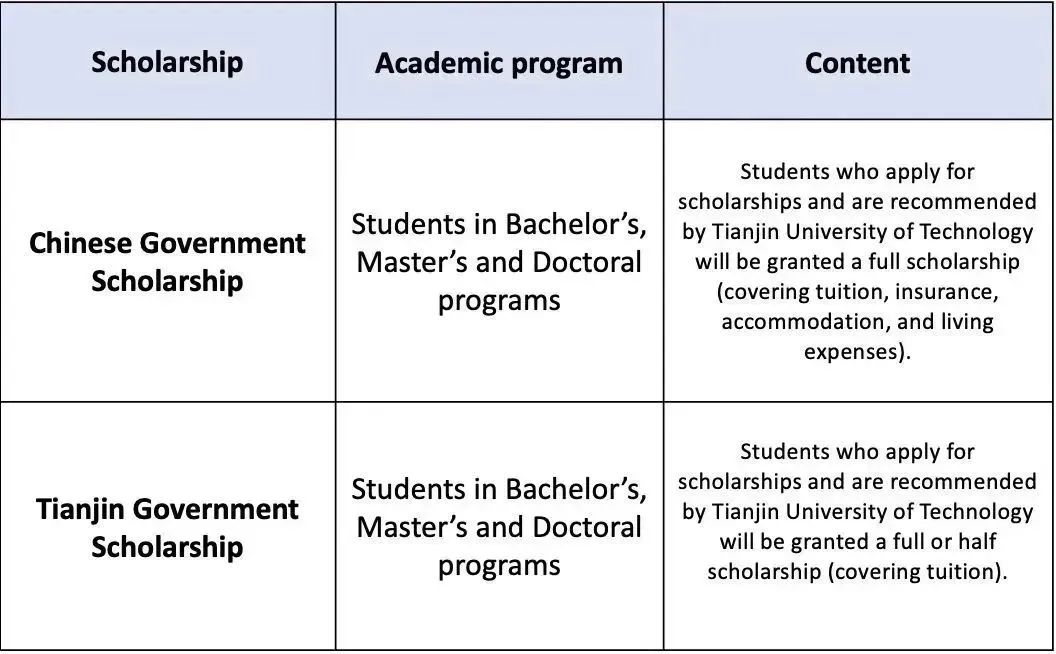

Several factors can influence student loan totals. First, the choice of institution plays a significant role; public universities generally have lower tuition rates compared to private colleges. Additionally, the length of the program and whether the student attends full-time or part-time can affect the total amount borrowed. Financial aid, scholarships, and grants can also reduce the overall loan totals, making it essential for students to explore all available funding options.

#### How to Calculate Your Student Loan Totals

To accurately assess student loan totals, students should begin by gathering all loan documents, including promissory notes and account statements. This information will help in calculating the total amount borrowed, including interest rates and repayment terms. Online calculators can also assist in estimating monthly payments and the total cost of the loan over time, providing a clearer picture of the financial commitment involved.

#### Strategies for Managing Student Loan Totals

Managing student loan totals can be challenging, but several strategies can help ease the burden. First, students should prioritize understanding their loan terms and repayment options. Federal loans often come with more flexible repayment plans compared to private loans, so it’s important to explore options such as income-driven repayment plans.

Additionally, making extra payments when possible can significantly reduce the overall interest paid over the life of the loan. Students should also consider loan consolidation or refinancing options, which may offer lower interest rates or more manageable monthly payments.

#### The Importance of Financial Literacy

As student loan totals continue to grow, financial literacy becomes increasingly vital. Understanding the implications of borrowing, budgeting for repayment, and planning for future financial goals can empower students to make informed decisions. Educational institutions and organizations are increasingly offering resources and workshops focused on financial literacy, which can be beneficial for students navigating their loan journeys.

#### Conclusion

In conclusion, student loan totals represent a significant aspect of the modern educational experience. By understanding what these totals entail and implementing effective management strategies, students can navigate their financial futures with greater confidence. It is essential to stay informed about loan options, repayment strategies, and available resources to ensure that education remains a pathway to opportunity rather than a source of overwhelming debt.