Exploring the Possibility: Can I Pay My Student Loans with a Credit Card?

Guide or Summary:Understanding Student LoansThe Role of Credit CardsCan I Pay My Student Loans with a Credit Card?Pros and Cons of Using a Credit CardAltern……

Guide or Summary:

- Understanding Student Loans

- The Role of Credit Cards

- Can I Pay My Student Loans with a Credit Card?

- Pros and Cons of Using a Credit Card

- Alternatives to Credit Card Payments

#### Translation of the Phrase:

"Can I pay my student loans with a credit card" translates to "Can I pay my student loans with a credit card."

#### Detailed Description:

Understanding Student Loans

Student loans are a common financial tool that many individuals utilize to fund their higher education. These loans come in various forms, including federal and private loans, each with its own terms, interest rates, and repayment options. As graduates enter the workforce, they often find themselves navigating the complexities of repayment, which can be overwhelming.

The Role of Credit Cards

Credit cards serve as a convenient method for making purchases and managing expenses. They allow individuals to borrow money up to a certain limit, which they can pay back over time, often with interest. Given the flexibility that credit cards offer, many borrowers wonder if they can leverage this payment method to manage their student loan obligations.

Can I Pay My Student Loans with a Credit Card?

The question, "Can I pay my student loans with a credit card?" is a common one among borrowers seeking alternative payment methods. The straightforward answer is that it depends on the lender. Most federal student loan servicers do not accept credit card payments directly. However, borrowers can explore third-party services that facilitate credit card payments for student loans, often for a fee.

Pros and Cons of Using a Credit Card

Using a credit card to pay student loans can have both advantages and disadvantages.

**Pros:**

1. **Rewards and Benefits**: Some credit cards offer rewards, cash back, or travel points for purchases. Paying student loans with a rewards card could potentially earn you benefits.

2. **Flexibility**: Credit cards can provide flexibility in managing cash flow, particularly if you are facing temporary financial difficulties.

**Cons:**

1. **High Interest Rates**: Credit cards typically have higher interest rates compared to student loans. If you cannot pay off the credit card balance quickly, you may end up accruing more debt.

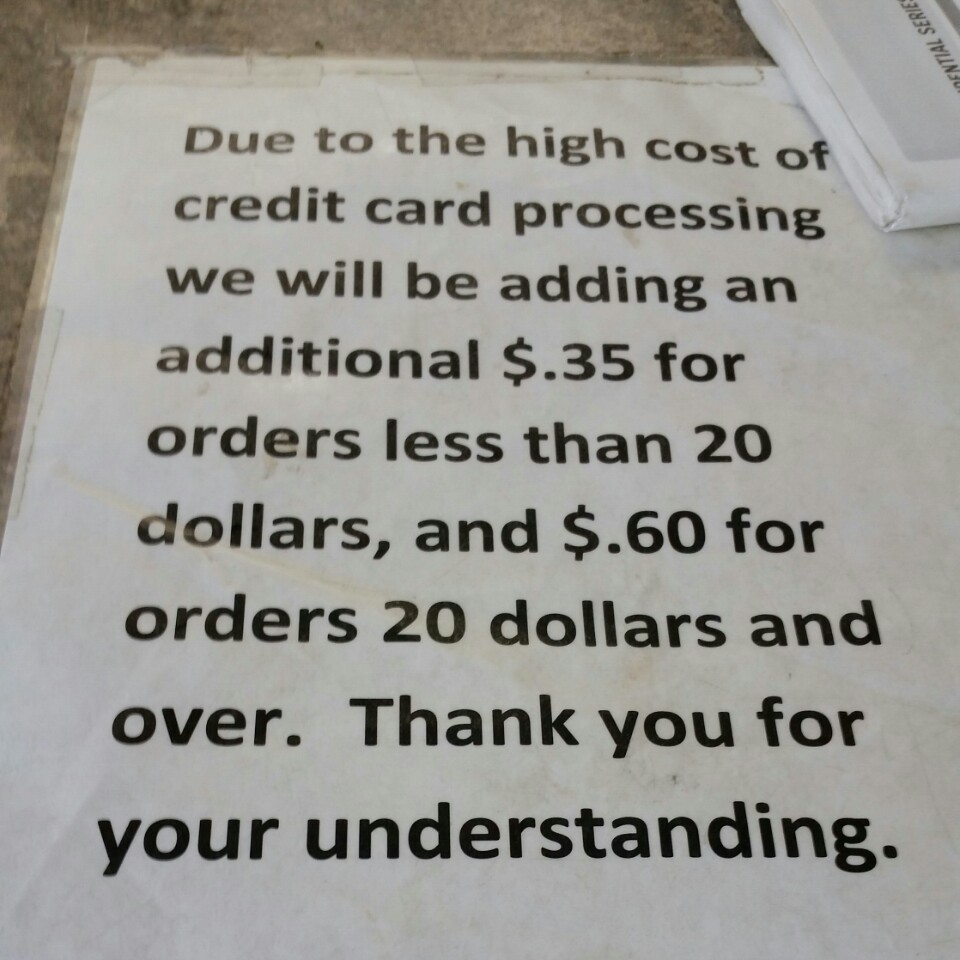

2. **Fees**: Third-party services that allow credit card payments may charge fees, which can negate any rewards you earn.

3. **Debt Accumulation**: Relying on credit cards for loan payments can lead to a cycle of debt, making financial situations worse.

Alternatives to Credit Card Payments

If paying student loans with a credit card does not seem like a viable option, there are alternatives to consider.

1. **Direct Bank Transfers**: Most lenders allow borrowers to set up automatic payments from their bank accounts, which can help manage payments efficiently.

2. **Refinancing**: For those with high-interest loans, refinancing may offer lower rates and better terms, making repayment more manageable.

3. **Income-Driven Repayment Plans**: Federal loans offer income-driven repayment plans that adjust monthly payments based on income, providing financial relief.

In summary, while the question "Can I pay my student loans with a credit card?" has no definitive answer due to varying lender policies, it is essential for borrowers to weigh the pros and cons carefully. Understanding the implications of using credit cards for student loan payments can help individuals make informed financial decisions. Exploring alternative repayment strategies may ultimately provide a more sustainable approach to managing student loan debt.