Understanding the Impact of a $30,000 Personal Loan Monthly Payment on Your Finances

#### $30,000 Personal Loan Monthly PaymentWhen considering a $30,000 personal loan monthly payment, it’s crucial to understand how this figure affects your……

#### $30,000 Personal Loan Monthly Payment

When considering a $30,000 personal loan monthly payment, it’s crucial to understand how this figure affects your overall financial situation. Personal loans have become a popular financial tool for many individuals seeking to consolidate debt, fund major purchases, or cover unexpected expenses. However, the monthly payment amount can significantly influence your budget and financial health.

#### Factors Influencing Monthly Payments

The monthly payment for a $30,000 personal loan can vary based on several factors, including the loan term, interest rate, and your credit score. Generally, personal loans are offered with terms ranging from 2 to 7 years. A longer loan term typically results in lower monthly payments but may increase the total interest paid over the life of the loan.

Interest rates are another critical factor. Borrowers with higher credit scores usually qualify for lower interest rates, which can substantially reduce monthly payments. Conversely, those with lower credit scores may face higher rates, leading to increased monthly obligations.

#### Calculating Your Monthly Payment

To estimate your $30,000 personal loan monthly payment, you can use a loan calculator or apply the formula for calculating monthly payments on an installment loan. The formula is as follows:

\[ M = P \times \frac{r(1 + r)^n}{(1 + r)^n - 1} \]

Where:

- \( M \) is the total monthly payment

- \( P \) is the loan amount ($30,000)

- \( r \) is the monthly interest rate (annual rate divided by 12)

- \( n \) is the number of payments (loan term in months)

For example, if you take out a $30,000 personal loan at an annual interest rate of 6% for 5 years, your monthly payment would be approximately $579.98.

#### Budgeting for Your Monthly Payment

Once you have calculated your $30,000 personal loan monthly payment, it's essential to integrate this amount into your monthly budget. Review your income and expenses to ensure you can comfortably afford the payment without compromising your financial stability. It’s advisable to follow the 50/30/20 budgeting rule, where 50% of your income goes to necessities, 30% to discretionary spending, and 20% to savings and debt repayment.

#### Benefits and Risks of Personal Loans

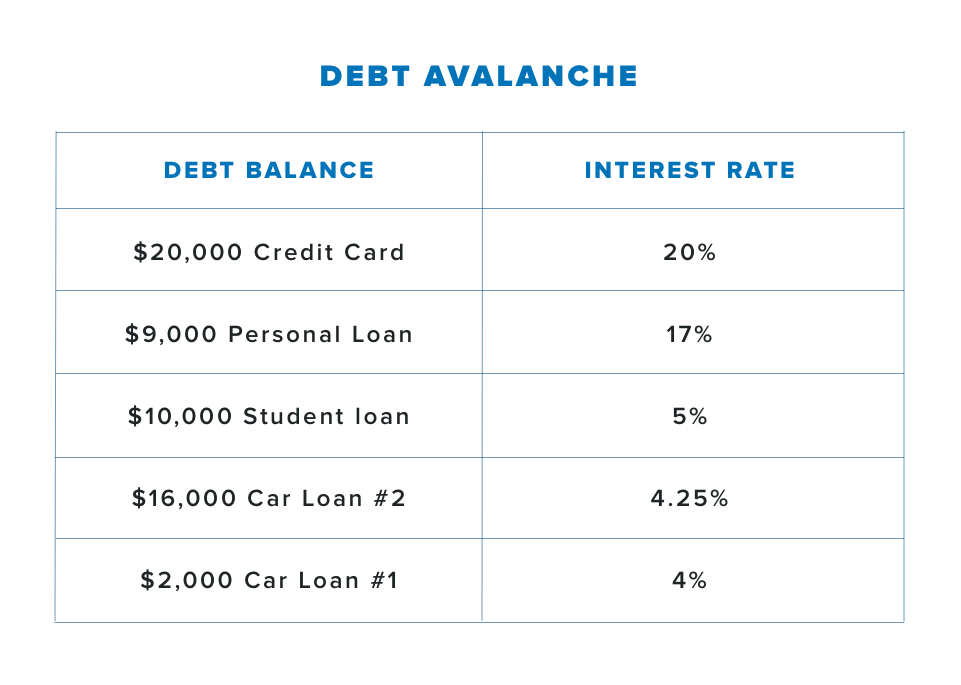

Taking out a personal loan can offer several benefits, including the ability to consolidate high-interest debt into a single, more manageable payment. Additionally, personal loans can provide immediate funds for emergencies or significant purchases, allowing you to maintain cash flow.

However, there are risks associated with personal loans. If you fail to make your monthly payments, you could damage your credit score and face additional fees. It’s essential to assess your ability to repay the loan before committing to ensure it aligns with your financial goals.

#### Conclusion

In summary, understanding the implications of a $30,000 personal loan monthly payment is vital for anyone considering this financial option. By evaluating the factors that influence your monthly payment, calculating your potential costs, and budgeting accordingly, you can make informed decisions that support your financial well-being. Always consider your long-term financial goals and consult with a financial advisor if you have any doubts or questions about taking on a personal loan.