Understanding What Credit Score is Needed for USDA Home Loan: A Comprehensive Guide for Homebuyers

#### What Credit Score is Needed for USDA Home LoanIf you're considering purchasing a home in a rural area, you may have heard about USDA loans, which are d……

#### What Credit Score is Needed for USDA Home Loan

If you're considering purchasing a home in a rural area, you may have heard about USDA loans, which are designed to help low to moderate-income individuals or families achieve homeownership. One of the key factors in qualifying for a USDA home loan is your credit score. In this article, we will delve into what credit score is needed for USDA home loan approval, the benefits of these loans, and tips for improving your credit score to enhance your chances of securing financing.

#### The Basics of USDA Home Loans

USDA home loans are backed by the United States Department of Agriculture and are aimed at promoting homeownership in rural areas. These loans offer several advantages, including no down payment, lower mortgage insurance costs, and competitive interest rates. However, to qualify for a USDA loan, prospective borrowers must meet certain eligibility criteria, including income limits and credit score requirements.

#### What Credit Score is Needed for USDA Home Loan?

The minimum credit score required for a USDA home loan is typically 640. This benchmark score is necessary to streamline the application process and ensure that borrowers have a reasonable credit history. However, it's important to note that while a score of 640 is the standard, some lenders may consider borrowers with lower scores on a case-by-case basis, especially if they have compensating factors such as a stable income or a significant down payment.

#### Factors Influencing Credit Score Requirements

While the USDA sets a minimum credit score requirement, individual lenders may have their own criteria. Factors that can influence the credit score needed for a USDA home loan include:

1. **Debt-to-Income Ratio (DTI)**: Lenders will assess your DTI ratio, which compares your monthly debt payments to your gross monthly income. A lower DTI can help compensate for a lower credit score.

2. **Employment History**: A stable employment history can positively impact your application, even if your credit score is on the lower side.

3. **Credit History**: Lenders will look at your overall credit history, including any late payments, bankruptcies, or foreclosures. A clean credit history can sometimes outweigh a slightly lower credit score.

4. **Compensating Factors**: If you have significant savings, a larger down payment, or a co-signer with a strong credit profile, these factors can help improve your chances of approval despite a lower credit score.

#### Tips for Improving Your Credit Score

If your credit score is below the required threshold for a USDA loan, don't be discouraged. Here are some actionable steps you can take to improve your credit score:

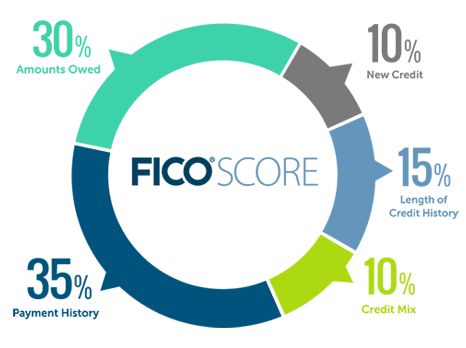

1. **Pay Your Bills on Time**: Consistently making on-time payments is one of the most effective ways to boost your credit score.

2. **Reduce Credit Card Balances**: Aim to keep your credit utilization ratio below 30%. Paying down existing debt can have a positive impact on your score.

3. **Check Your Credit Report**: Regularly review your credit report for errors or inaccuracies. Disputing any incorrect information can help improve your score.

4. **Avoid Opening New Credit Accounts**: Each time you apply for new credit, it can temporarily lower your score. Focus on improving your existing credit before taking on new debt.

5. **Consider Credit Counseling**: If you're struggling to manage your credit, seeking help from a credit counseling service can provide you with strategies to improve your financial situation.

#### Conclusion

Understanding what credit score is needed for USDA home loan approval is crucial for potential homebuyers looking to take advantage of this beneficial financing option. With a minimum credit score of 640, it's essential to maintain a healthy credit profile and be aware of the various factors that can influence your eligibility. By taking proactive steps to improve your credit score and working closely with lenders, you can increase your chances of securing a USDA home loan and achieving your dream of homeownership in a rural area.