Effective Strategies for Successful Bank Loan Recovery: A Comprehensive Guide

#### Bank Loan RecoveryIn the financial landscape, bank loan recovery plays a crucial role in maintaining the stability of lending institutions and ensuring……

#### Bank Loan Recovery

In the financial landscape, bank loan recovery plays a crucial role in maintaining the stability of lending institutions and ensuring that borrowers meet their obligations. The process of recovering loans is not merely about collecting debts; it involves a strategic approach that balances the interests of the bank and the borrower. This guide explores effective strategies that banks can implement to enhance their loan recovery rates, ensuring a win-win situation for both parties involved.

#### Understanding Bank Loan Recovery

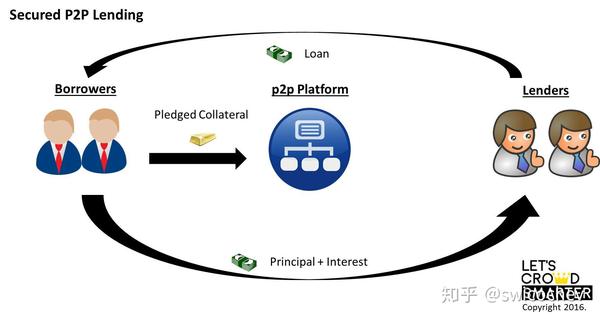

Bank loan recovery refers to the methods and processes employed by financial institutions to reclaim funds lent to borrowers who are unable to meet their repayment obligations. This situation can arise due to various reasons, including financial hardship, mismanagement of funds, or unforeseen circumstances. The goal of bank loan recovery is not only to recover the outstanding amount but also to maintain a positive relationship with customers, which can lead to future business opportunities.

#### Strategies for Effective Bank Loan Recovery

1. **Early Intervention**: One of the most effective strategies in bank loan recovery is early intervention. Banks should monitor loan accounts closely and identify potential delinquencies as soon as they arise. By reaching out to borrowers early, banks can offer assistance and solutions, such as restructuring the loan or providing temporary relief, which may prevent default.

2. **Communication and Negotiation**: Open communication is vital in the recovery process. Banks should establish a dialogue with borrowers to understand their circumstances and negotiate repayment plans that are manageable for the borrower. This approach not only increases the chances of recovery but also fosters goodwill and trust.

3. **Utilizing Technology**: In today’s digital age, technology plays a significant role in bank loan recovery. Banks can leverage data analytics to identify at-risk borrowers and tailor their recovery strategies accordingly. Automated systems can also streamline communication and follow-ups, making the recovery process more efficient.

4. **Training Recovery Teams**: Investing in training for recovery teams is essential. Staff should be equipped with the skills to handle sensitive situations with empathy and professionalism. A well-trained team can effectively negotiate and implement recovery strategies that consider the borrower’s situation while still aiming to recover the debt.

5. **Legal Action as a Last Resort**: While legal action is sometimes necessary, it should always be considered a last resort in bank loan recovery. Pursuing legal avenues can be costly and time-consuming, and it may damage the relationship with the borrower. Banks should explore all other options before resorting to litigation.

#### Conclusion

In conclusion, successful bank loan recovery requires a multifaceted approach that combines early intervention, effective communication, technological advancements, and well-trained staff. By adopting these strategies, banks can improve their recovery rates while maintaining positive relationships with their customers. This not only benefits the financial institution but also supports borrowers in overcoming their financial challenges, ultimately contributing to a healthier economy. As the financial landscape continues to evolve, staying ahead with innovative recovery strategies will be key to success in the banking sector.