Understanding Car Loan Rates at Wells Fargo: A Comprehensive Guide to Financing Your Vehicle

#### Car Loan Rates Wells FargoWhen it comes to financing your next vehicle, understanding the intricacies of car loan rates Wells Fargo is essential. Wells……

#### Car Loan Rates Wells Fargo

When it comes to financing your next vehicle, understanding the intricacies of car loan rates Wells Fargo is essential. Wells Fargo, one of the leading banks in the United States, offers a variety of auto loan options tailored to meet the needs of diverse borrowers. Whether you are purchasing a new car, a used vehicle, or refinancing an existing loan, knowing the rates and terms available can significantly influence your financial decision.

#### What Affects Car Loan Rates?

Several factors can impact the car loan rates Wells Fargo offers. These include:

1. **Credit Score**: Your credit score is one of the most significant determinants of the interest rate you will receive. Higher credit scores typically lead to lower rates, while lower scores can result in higher rates.

2. **Loan Term**: The length of the loan affects the rate as well. Generally, shorter-term loans come with lower interest rates but higher monthly payments, while longer-term loans may have higher rates but lower monthly payments.

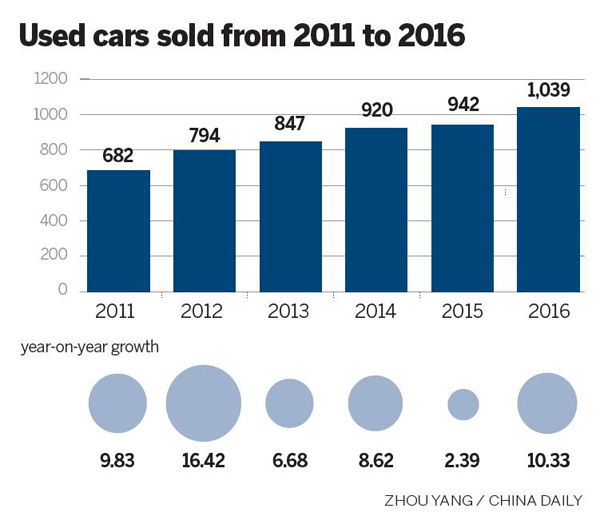

3. **Vehicle Type**: The type of vehicle you are financing can also influence your rate. New cars often have lower rates compared to used cars because they are considered less risky by lenders.

4. **Down Payment**: A larger down payment can reduce the amount you need to finance, which may lead to a lower interest rate.

5. **Market Conditions**: Economic factors and market trends can affect interest rates. It's important to stay informed about overall market conditions when considering a car loan.

#### Benefits of Choosing Wells Fargo for Your Car Loan

Wells Fargo offers several advantages that make it an attractive option for car financing:

- **Competitive Rates**: With a range of rates available, Wells Fargo often provides competitive options that can fit various budgets.

- **Flexible Terms**: Borrowers can choose from various loan terms, allowing for customized payment plans that suit individual financial situations.

- **Online Tools**: Wells Fargo provides online calculators and tools to help potential borrowers estimate their monthly payments and understand their financing options better.

- **Customer Support**: With a strong reputation for customer service, Wells Fargo offers support throughout the loan process, ensuring borrowers have access to assistance when needed.

#### How to Apply for a Car Loan at Wells Fargo

Applying for a car loan at Wells Fargo is a straightforward process. Here are the steps you can follow:

1. **Check Your Credit Score**: Before applying, it’s wise to check your credit score and address any issues that may affect your rate.

2. **Gather Documentation**: Prepare necessary documents, including proof of income, identification, and information about the vehicle you wish to purchase.

3. **Visit the Wells Fargo Website**: Start your application online by visiting the Wells Fargo auto loan section. You can also visit a local branch if you prefer in-person assistance.

4. **Complete the Application**: Fill out the application form, providing accurate information to facilitate a smooth approval process.

5. **Review Loan Offers**: Once approved, review the loan offers carefully, paying attention to interest rates, terms, and any fees associated with the loan.

6. **Finalize the Loan**: After choosing the best offer for your situation, finalize the loan and complete the paperwork to secure your financing.

#### Conclusion

Navigating the world of auto financing can be daunting, but understanding car loan rates Wells Fargo and the factors that influence them can empower you to make informed decisions. By considering your credit score, loan terms, and the benefits that Wells Fargo offers, you can find a car loan that fits your financial needs. Whether you are a first-time buyer or looking to refinance, Wells Fargo provides a range of options to help you achieve your automotive goals.