"How to Choose the Best Loan Providers for Your Financial Needs"

Guide or Summary:Understanding Loan ProvidersTypes of Loan ProvidersFactors to Consider When Choosing Loan ProvidersThe Importance of Credit ScoresConclusio……

Guide or Summary:

- Understanding Loan Providers

- Types of Loan Providers

- Factors to Consider When Choosing Loan Providers

- The Importance of Credit Scores

- Conclusion: Making the Right Choice

Understanding Loan Providers

Loan providers are financial institutions or individuals that offer money to borrowers with the expectation that the borrowed amount will be paid back with interest over a specified period. They play a crucial role in the economy by facilitating access to funds for various purposes, such as purchasing a home, financing education, or consolidating debt. With a plethora of loan providers available in the market, it becomes essential for borrowers to understand what these providers offer and how to choose the right one for their specific needs.

Types of Loan Providers

There are several types of loan providers, each catering to different financial requirements. Traditional banks are among the most common loan providers, offering a range of loan products, including personal loans, mortgages, and auto loans. Credit unions are another option, often providing lower interest rates and more personalized service compared to banks. Online lenders have gained popularity in recent years, offering quick and convenient loan applications with competitive rates. Peer-to-peer lending platforms connect borrowers directly with individual investors, which can sometimes lead to better terms.

Factors to Consider When Choosing Loan Providers

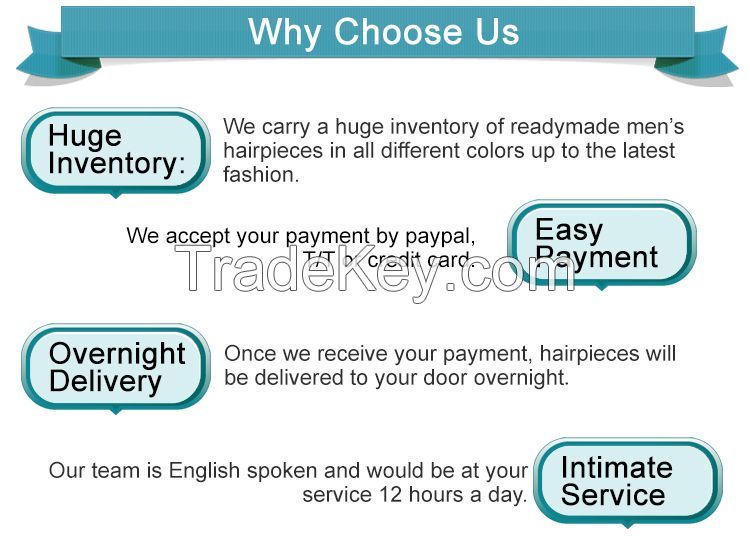

When selecting a loan provider, several factors should be taken into account to ensure you make an informed decision. First, assess the interest rates offered by different providers. Even a small difference in rates can lead to significant savings over time. Next, consider the fees associated with the loan, including origination fees, late payment penalties, and prepayment penalties. It's also crucial to look at the loan terms, such as repayment periods and flexibility in payment options.

Customer service is another vital aspect to consider. A loan provider with a responsive and helpful customer service team can make the borrowing process much smoother. Additionally, read reviews and testimonials from previous borrowers to gauge the provider's reputation. Transparency in terms and conditions is essential; ensure that you fully understand the loan agreement before committing.

The Importance of Credit Scores

Your credit score plays a significant role in determining which loan providers will approve your application and the terms they offer. A higher credit score typically translates to better interest rates and loan terms. Therefore, it's advisable to check your credit report for any inaccuracies and take steps to improve your score before applying for a loan. Some loan providers specialize in working with individuals with lower credit scores, but these loans may come with higher interest rates.

Conclusion: Making the Right Choice

In conclusion, choosing the right loan provider is a critical step in securing the financing you need. By understanding the different types of loan providers, considering essential factors such as interest rates and fees, and being aware of your credit score, you can make an informed decision that aligns with your financial goals. Take the time to research and compare various loan providers to find the best fit for your situation. Remember, the right loan provider can make a significant difference in your borrowing experience and overall financial health.