Unlocking the Benefits of Student Loan Public Service Forgiveness: A Comprehensive Guide for Eligible Borrowers

#### Student Loan Public Service ForgivenessThe Student Loan Public Service Forgiveness (PSLF) program is a vital initiative designed to alleviate the finan……

#### Student Loan Public Service Forgiveness

The Student Loan Public Service Forgiveness (PSLF) program is a vital initiative designed to alleviate the financial burden on individuals who dedicate their careers to public service. This program offers forgiveness on federal student loans after a borrower has made 120 qualifying monthly payments while working full-time for a qualifying employer. Understanding the intricacies of the PSLF program can be the key to unlocking significant financial relief for those committed to serving their communities.

#### Eligibility Criteria for PSLF

To qualify for the Student Loan Public Service Forgiveness program, borrowers must meet specific criteria. First, they need to be employed full-time by a government or non-profit organization. This includes federal, state, local, or tribal government agencies and non-profit organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code. Additionally, borrowers must have Direct Loans or consolidate other federal loans into a Direct Consolidation Loan.

#### Qualifying Payments and Employment

One of the most crucial aspects of the PSLF program is the requirement to make 120 qualifying payments. These payments must be made under a qualifying repayment plan, such as an Income-Driven Repayment (IDR) plan. It’s essential for borrowers to ensure that their payments are made on time and in full to count toward the forgiveness total. Moreover, each payment must be made while the borrower is employed full-time at a qualifying employer.

#### Application Process for PSLF

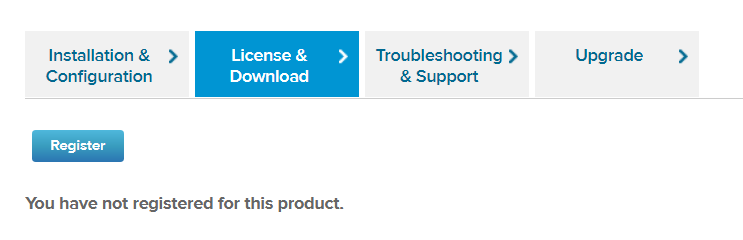

The application process for the Student Loan Public Service Forgiveness program can seem daunting, but understanding the steps can simplify it. Borrowers should start by submitting the Employment Certification Form (ECF) annually or whenever they change employers. This form helps track qualifying employment and payments. After making 120 qualifying payments, borrowers can submit the PSLF application to have their remaining loan balance forgiven.

#### Common Misconceptions about PSLF

There are several misconceptions surrounding the PSLF program that can lead to confusion. One common myth is that all federal loans qualify for forgiveness. However, only Direct Loans are eligible unless they are consolidated into a Direct Consolidation Loan. Another misconception is that borrowers can receive automatic forgiveness after 10 years of service. In reality, borrowers must actively apply for forgiveness after meeting the payment requirements.

#### Benefits of PSLF

The benefits of the Student Loan Public Service Forgiveness program are substantial. For borrowers who qualify, the program can lead to the cancellation of a significant portion of their student debt, allowing them to focus on their careers and communities without the heavy burden of student loans. Additionally, participating in public service can be incredibly rewarding, providing a sense of purpose and fulfillment while also contributing positively to society.

#### Conclusion

In conclusion, the Student Loan Public Service Forgiveness program offers a valuable opportunity for those dedicated to public service to achieve financial relief from their student loans. By understanding the eligibility criteria, application process, and common misconceptions, borrowers can better navigate the complexities of PSLF. With the right information and commitment, individuals can unlock the benefits of this program and pave the way for a brighter financial future.